One of the strongest arguments in favor of the legalization of cannabis has been the positive economic impact it will have on the economy, especially when it comes to job creation and tax revenue.

As it stands, 34 states and Washington D.C. have laws that allow for some sort of legalization of cannabis, and 11 of those states have legalized recreational use.

- Alaska

- California

- Colorado

- Illinois

- Maine

- Massachusetts

- Michigan

- Nevada

- Oregon

- Vermont

- Washington

- Washington, DC

New Frontier Data, an organization that watches and measures the cannabis industry, speculates that if cannabis were legal in all 50 states and at the federal level, there could be 1.46 million cannabis jobs, $8.4 billion in payroll taxes, and $175.8 billion in revenue from combined taxes (more on what that means in the next section).

Economic Benefits of Marijuana

Tax revenues from the legalized cannabis industry can come in several forms. In Massachusetts, for example, the state charges 10.75% on retail sales on top of the state tax of 6.25%. Local governments in Massachusetts are allowed to tack up to 3% on top of the state taxes. There are other states that tax growers a “cultivation tax,” which is a flat fee based on some unit of weight (per ounce of dried flower, for example).

Sales taxes from cannabis

Consumers pay this tax, which is levied by state and local governments based on a percentage of the sticker price. For example, Nevada’s cannabis consumers pay 10% state sales tax plus a 15% excise tax on cannabis. California residents can pay up to 80% in sales tax, Oregon has a 17% sales tax, and Washington has a 37% sales tax. Comparatively, what we pay in Massachusetts at 20% is not that high.

Excise taxes on cannabis

Either consumers or retailers might pay excise taxes, depending on the state and the transaction (excise taxes can be levied on grower-retailer transactions and retailer-consumer transactions, for example).

Excise taxes are levied by state and local governments. They differ from sales taxes because they are levied on specific goods like gas, cigarettes, and cannabis on top of state sales taxes. Colorado levies a 15% state excise tax on cannabis sales.

Cannabis cultivation taxes

Growers pay taxes based on weights. For example, California’s growers pay $9.25 per ounce of dried cannabis.

Cannabis on the ballot — follow the initiatives nationwide

If you’d like to follow cannabis-related legislation throughout the U.S., Ballotpedia is a nonpartisan organization that follows a number of political races and ballot initiatives throughout the U.S., including cannabis-related initiatives and amendments. You can also see a timeline of cannabis-legalization efforts dating back to 1972.

Impact of Cannabis Industry Jobs on the Economy

Since states have been legalizing cannabis, more than 243,000 jobs have been added nationwide, according to Leafly. New Frontier Data estimates that even more cannabis jobs have been created — more than 340,000 — since states started legalizing recreational and medical cannabis use.

The top states for cannabis-related occupations are Massachusetts, Oklahoma, and Illinois, according to New Frontier.

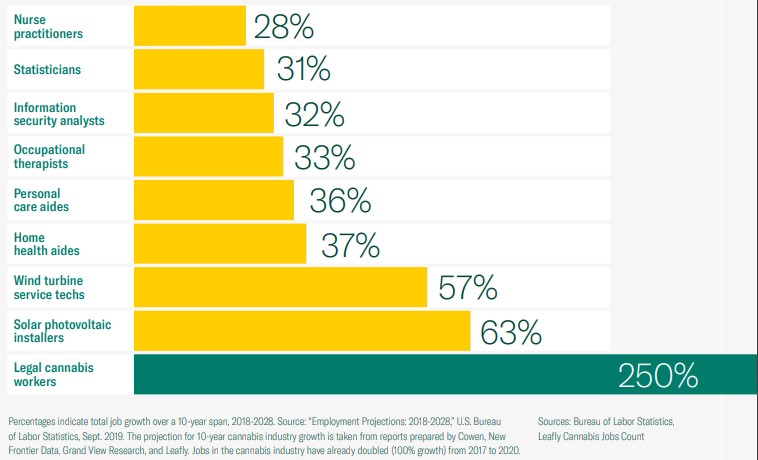

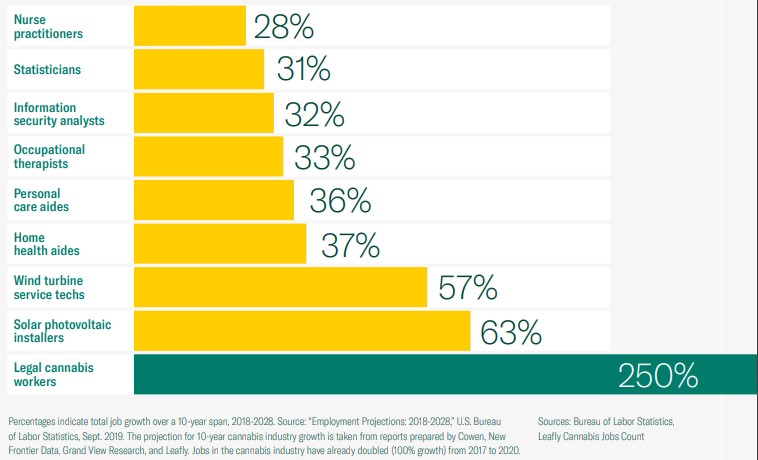

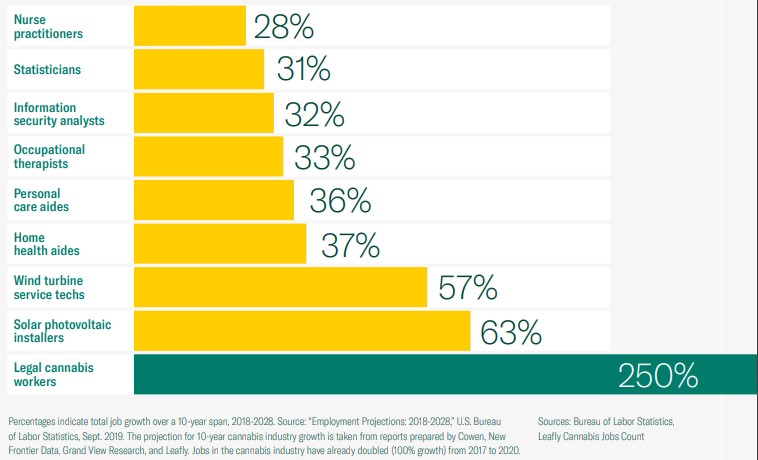

Legal cannabis workers are among the fastest growing occupations, according to Leafly, which compared cannabis job growth to other fast-growing occupations to estimate a 250% growth in jobs from 2018 to 2028.

Types of jobs in the cannabis industry

View this post on Instagram

Jobs in the cannabis industry are blossoming (see what we did there?), and job growth is expected to continue to increase for at least the next decade, according to the Leafly Jobs Report 2020. From growers and harvesters, to retailers, and even marketers, the industry employs a variety of people.

Here are some of the most popular jobs in the cannabis industry:

- Cultivation and Manufacturing: Growers, harvesters, trimmers, packagers, and production managers handle the “seed to sale” processes of cannabis production. They work at agricultural facilities, extraction laboratories, and manufacturing plants in states where growing and processing cannabis is legal.

- Kitchen: Making edibles, infused candies, and creating new formulations. Must have experience in food.

- Budtender: At Happy Valley we refer to our budtenders as “hosts.” This job is a retail setting at the dispensary. These are trained cannabis experts who can educate customers on the various cultivars and cannabis-related products.

- Delivery: These individuals are especially important in states where medical cannabis needs to be delivered to people who are homebound because of serious illnesses. However, delivery of adult use cannabis is also available in some states.

- Sales and marketing: Like any business that provides goods to customers, the cannabis industry needs people who specialize in sales, marketing, administrative, legal, financial, and other operational roles.

Cannabis Jobs in Massachusetts

Legalization of cannabis has created more than 13,000 full-time jobs in Massachusetts, according to the Leafly Jobs Report 2020, and the industry is expected to continue to grow. Sales statewide were $156 million in 2018, $404 million in 2019, and they’re expected to reach $700 million in 2020.

If you’re interested in working in the cannabis industry in Massachusetts, view our current openings at Happy Valley. We pride ourselves on paying slightly above the industry standard because we want to hire the best. Our compensation includes medical, dental, vision and paid holidays and vacation.

Learn more about our story and our commitment to excellence in the cannabis industry.

For more cannabis news, how-to articles and tutorials, and product and specials alerts, sign up for our newsletter. Become a Happy Valley Insider by entering your email address in the prompt below (see Stay Connected section).